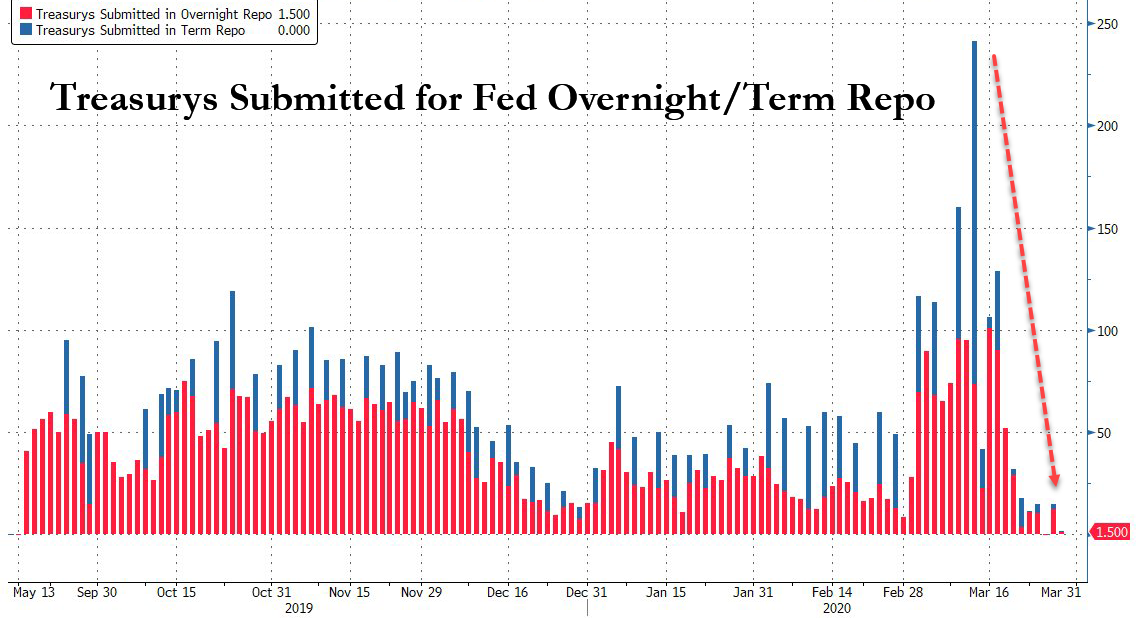

The Federal Reserve is both buying bonds and paying banks to park their bonds with the fed for a while. Looks like no one is parking them. You can count on the fed paying the banks above-market rates for those bonds with either option, otherwise they wouldn't use the fed, they would just sell or lease them on the open market. It looks like the real reason for the failure of the repo market is that banks are desperate to dump treasury debt. They don't want to hang onto it and rent it out to people who temporarily want collateral.

An analogy would be if the big landlords in a town realized their community was going to lose its largest employers shortly and that the demand for rent houses was about to plummet. So they want to sell the houses and get out before its clear they are worth less. But if they all try to sell at once, the market will respond to that by causing the price of a house to go down. So it is a lose-lose for the landlords. They misallocated capital. But of course in this world, where the big banks own the political system, they believe that socialism is the answer - for their losses. They will keep their profits. They want the US government to buy their "houses" at what was the market price, before things went south.

So at the risk of using too many analogies, imagine you have the right to have someone flip a coin. If its heads you win $100, if it is tails, you get nothing. That right is worth $50. Let's say you bought that right from someone else for $49. If you do that 1,000 times a day you keep the spread and do well. This amounts to waiting for the coin to be flipped, and if you lose, selling the "right to the profits" to the government as if you could still win the coin toss. It's pretending that the instrument is still worth $50 before we had price discovery and found out it was worth nothing. That's kind of like what the banks are now doing to all of the rest of us every day on a large scale, with the full approval of your favorite politician and your most hated politician of both parties.

Whatever the answer to stopping this looting is, it isn't continuing to vote for one of the two established private political clubs that the media owned by the same folks keep telling you are your only options.

This is a bail-out for the banks at what will ultimately be the expense of the rest of us, and that is criminal and treasonous enough, especially since your favorite politicians are all going along with it. But why is this a harbinger of doom? We should be very alarmed that the banks are all choosing to sell rather than rent their bonds to the fed. This can only mean they expect those bonds to go down further in the future and are dumping a bad investment. When bonds go down, it is because interest rates rise.

There is no way our economy can prosper with rising interest rates, but with so much debt to sell, the market pressure for rates to increase will be enormous. Either the economy will crash due to much higher interest, or the dollar will crack due to much higher inflation if they suppress interest rates. Or both could happen, a return to 1970's style deflation.

No comments:

Post a Comment