I am well aware of how human nature works. Mark Twain said "it is easier to fool people than to convince them they have been fooled." Indeed, the normal human reaction to someone explaining how a person has been conned is for that person to lash out at the explainer, and double-down on defending the person conning them. So be it. My obligation is to give the warning. Hopefully, if enough give the warning this plan won't come to pass. If it does, then hopefully, the more noble of those who I warned will at least remember that I tried to warn them. There is another class of persons who will persist in error even if it means the world burns, because they want everything to change except themselves. Warnings are wasted on such persons. They are born to be used by those who will tell them what they want to hear. People who want to be lied to will always get their wish.

I hope the plan is stopped. If this plan is implemented and it turns out to be a good thing, never listen to anything I say ever again. But if I'm right when leading lights from both parties and the "Qs" of this world are pulling for it, remember who saw it coming.

Most people who are against the federal reserve gravitate towards that quote where one of the guys founding it was supposed to have said "we will charge them interest on money we create out of thin air." That really doesn't apply to taxpayers directly though. The Federal Reserve is really a bunch of private banks who have a special relationship with the Federal Government, not a government agency. And according to the arrangement, any profits they get from interest payments are to be remitted to the U.S. Treasury. So the interest they get from thin air is mostly not so direct as all that. Were the scam that simple, most people would catch on and demand that it be ended.

They have to have more shells in the game to pull off the crime, but the subtle execution does not lessen the magnitude of the theft. They can still steal vast amounts of wealth, without most people ever connecting the dots. What the federal reserve allows them to do is to "over-leverage". That is, use a financial asset as the basis for creation of credit through debt to acquire another financial asset, which they then use as the basis for more credit creation and so forth.

Here's an example I give of leverage: If I borrow a billion to make a billion plus a million, then I am a millionaire even though I gained only one-tenth of one percent on the money I borrowed. But if I lose one-tenth of one percent, I am insolvent and can't even pay back all of the billion that I owe. What if I owe that to someone who is also highly levered and they need my money to stay solvent? Then the people they owe money to are in trouble. It is a house of cards built on leverage, which as I explain in my book, should be strictly regulated. This explains the basis for a lot of the "wealth" in our nation. We have corporations and people who are paper millionaires that have a billion dollars in debt.

Obviously that is extremely risky and no one could get away with it for long because even a slight miscalculation in which the value of what you own goes down would leave one insolvent. That's where the Federal Reserve comes in. What happened in 2008 was that a medium-sized default threatened to turn into a system crash because all the big players were highly-leveraged. The Fed launched several programs to make sure the big boys stayed solvent regardless of how reckless they had been using leverage. Of course, if you or I got strung out on debt, they'd take our homes.

The localist answer is to limit by law both global corporations and the leverage they use to buy up the world on credit. And hold officers of the bank personally responsible for the assets of the bank. The banker's answer is to make the tax payer the lender of last resort so that massive leverage can continue. The big picture is this will keep us tottering along a narrow path between deflationary collapse or hyper-inflationary financial ruin until we fall off one way or the other.

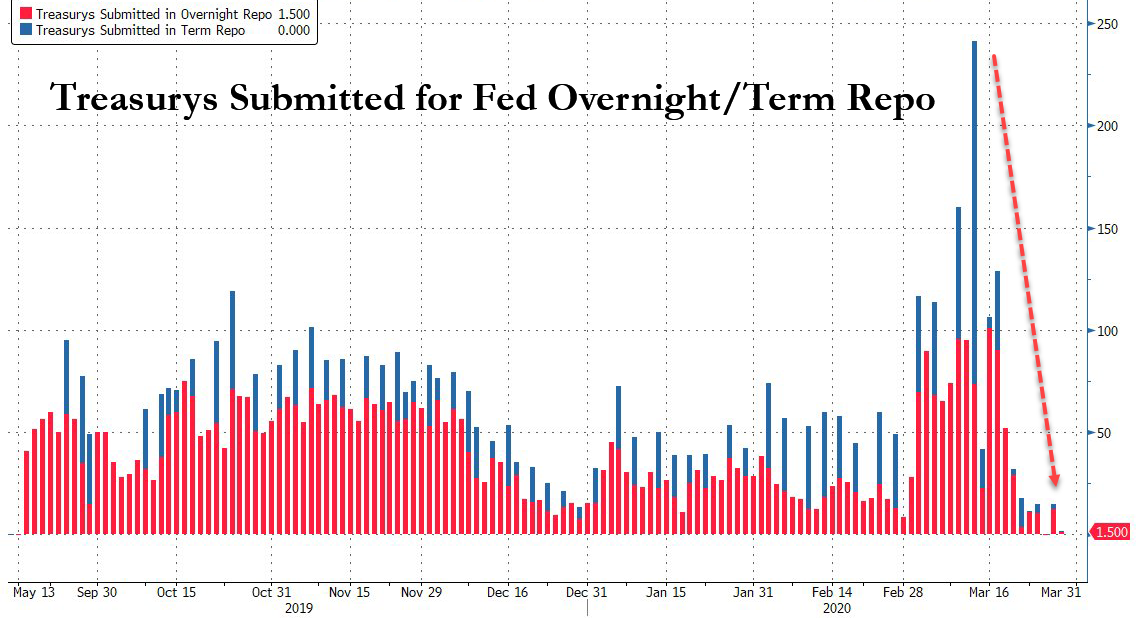

When the market would not supply the banks with the "liquidity" they needed, the federal reserve was there to buy the asset, or loan against it, at an above-market price. In this case "liquidity" really means "pay me for this 'asset' according to what I paid for it, not according to what the market prices it at now, so that I don't go down in a giant storm of debt." And the Federal Reserve has done it. Their balance sheet of stuff they have bought is huge. Far larger than it has traditionally been. They are buying their buddy's assets, propping up the price, but not selling the same stuff because putting more on the market would lower the price. The effect of their operations is to artificially lift the price of what they are massively buying.

That's also because if they sell the assets they would be taking money out of the market, and they need to keep pumping more money into the market to keep up with the ever-increasing amounts of leverage the big players are creating. If you need only 1% margin to protect against price shocks, every time a big bank levers up and creates another billion dollars then you need to pump in another ten million dollars to provide that margin. What if prices get volatile? Like they have lately. What if assets face a sustained drop in price, like they have lately? The Federal Reserve has tried make loans almost free for the big players, and it has tried every buy-back program allowed by law, but it isn't enough.

The second problem is that some of the assets the Fed bought may never reach the "market price" they paid for them. Some assets don't have a liquidity problem- a liquidity problem means it will take time before they can be sold at a profit but they are worth at least what you paid for them. This is different from a solvency problem. A solvency problem means the asset has lost real value and will never be sold for what was paid for it. The Federal Reserve can hide this for quite a while, because they can keep creating more money and credit and are never forced to "liquidate". As long as they pay below the maturity price for a secure asset that will pay 100% of the time, they can slowly transfer the losses of their friends onto the backs of everyone else holding dollars without it being noticed much.

The second problem is that some of the assets the Fed bought may never reach the "market price" they paid for them. Some assets don't have a liquidity problem- a liquidity problem means it will take time before they can be sold at a profit but they are worth at least what you paid for them. This is different from a solvency problem. A solvency problem means the asset has lost real value and will never be sold for what was paid for it. The Federal Reserve can hide this for quite a while, because they can keep creating more money and credit and are never forced to "liquidate". As long as they pay below the maturity price for a secure asset that will pay 100% of the time, they can slowly transfer the losses of their friends onto the backs of everyone else holding dollars without it being noticed much.

A hedge fund or investment bank may have bought a treasury that pays $1,000,000 in a years time for $998,500. Then used that asset as the basis for a loan for the price of the asset. In other words, leveraged. It works great when asset prices are going up. But when they are dropping, you borrowed money to buy something that lost value and you still owe the money. If the market price for bonds dropped to $995,000 they are stuck. That's where the Federal Reserve comes in. If you are one of the connected they can pay you an above-market price for that asset- like what you paid for it. They will still, on paper, make money just by holding it until it matures.

The fact that these people can buy certain government bonds and act like they still have the money they used to buy the bonds has made the bonds super popular, even if they pay little interest. In some places, the government bonds have negative interest. The buyer pays to loan the government money. They pay $1,000,100 for the right to a government bond that will pay them only $1,000,000 in a year. Ever wondered who would do something that dumb? It's not dumb if they can have the promise of $1,000,000 in a year and in the meantime still get the money in a low interest loan used to buy higher-interest securities. That works great so long as the securities keep going up in price. That's the key to keeping this asylum running.

But negative interest rates are the end of the road for the Federal Reserve's tactic of bailing out its friends while still showing a paper profit. It would show a paper loss on that transaction, and an overall loss if it didn't have a large supply of instruments which paid at least some interest. And that's where we are. And their friends now have widespread losses on a whole range of securities that they bought with borrowed money. They are bankrupt billionaires with friends in high places.

But negative interest rates are the end of the road for the Federal Reserve's tactic of bailing out its friends while still showing a paper profit. It would show a paper loss on that transaction, and an overall loss if it didn't have a large supply of instruments which paid at least some interest. And that's where we are. And their friends now have widespread losses on a whole range of securities that they bought with borrowed money. They are bankrupt billionaires with friends in high places.

That's where this new scheme comes in. I will quote from the Bloomberg article starting with a long list of asset-purchase programs which will be run by the U.S. Treasury, not the federal reserve. The federal reserve will merely provide loans to the Treasury to fund the bailouts.....

There will be no unwind this time and if there is, it will be at a titanic loss borne by the taxpayers. The financiers learned that they were too big to fail and kept going back to the casino. They are about to take all of their losing bets to the Treasury, which will buy them at an above-market price- if it wasn't an above market price, the owners could just sell it on the market. Wall Street will keep its profitable investments, and unload its bad investments on the rest of us. This is going to be a massive dump of toxic trash to the taxpayers books.

I have been saying since the 2008 bailouts that this was going to be a situation where the connected dump all of their losing investments on the taxpayers while keeping the winnings for themselves. But even then, I never understood how to get the last piece in place- those purchases from the 09 bailouts were not on the books of the U.S. Government, but the consortium of private banks managing our currency- the Federal Reserve System. I had wondered exactly how they were going to get their losing bets transferred to the taxpayers books. This is how. This is the conduit for the largest bank robbery in world history- but its the banks and hedge funds that are robbing the rest of us.

What I said at first, about the Federal Reserve not "charging interest off of money we create from thin air" directly from taxpayers won't apply anymore. The Federal Reserve will charge taxpayers interest for money they create out of thin air. If they remit that money back to the Treasury, it will only be so that Treasury can buy the losing assets of Federal Reserve Member banks at above-market prices. They have a system in place where they absolutely cannot lose money no matter what they do- but it is built on the backs of the honest labor of the rest of us. This plan is not some kind of godsend for the heartland, it is betrayal. Woodrow Wilson is supposed to have said on leaving office that he had "unwittingly betrayed his country". On his watch the Federal Reserve was created. Now, if he goes through with this, Donald Trump will also betray his country. We should pray that he doesn't follow through.

CPFF (Commercial Paper Funding Facility) – buying commercial paper from the issuer. PMCCF (Primary Market Corporate Credit Facility) – buying corporate bonds from the issuer. TALF (Term Asset-Backed Securities Loan Facility) – funding backstop for asset-backed securities. SMCCF (Secondary Market Corporate Credit Facility) – buying corporate bonds and bond ETFs in the secondary market. MSBLP (Main Street Business Lending Program) – Details are to come, but it will lend to eligible small and medium-size businesses, complementing efforts by the Small Business Association.

To put it bluntly, the Fed isn’t allowed to do any of this. The central bank is only allowed to purchase or lend against securities that have government guarantee. This includes Treasury securities, agency mortgage-backed securities and the debt issued by Fannie Mae and Freddie Mac. An argument can be made that can also include municipal securities, but nothing in the laundry list above.

So how can they do this? The Fed will finance a special purpose vehicle (SPV) for each acronym to conduct these operations. The Treasury, using the Exchange Stabilization Fund, will make an equity investment in each SPV and be in a “first loss” position. What does this mean? In essence, the Treasury, not the Fed, is buying all these securities and backstopping of loans; the Fed is acting as banker and providing financing. The Fed hired BlackRock Inc. to purchase these securities and handle the administration of the SPVs on behalf of the owner, the Treasury.

In other words, the federal government is nationalizing large swaths of the financial markets. The Fed is providing the money to do it. BlackRock will be doing the trades.

This scheme essentially merges the Fed and Treasury into one organization. So, meet your new Fed chairman, Donald J. Trump.

In 2008 when something similar was done, it was on a smaller scale. Since few understood it, the Bush and Obama administrations ceded total control of those acronym programs to then-Fed Chairman Ben Bernanke. He unwound them at the first available opportunity.

There will be no unwind this time and if there is, it will be at a titanic loss borne by the taxpayers. The financiers learned that they were too big to fail and kept going back to the casino. They are about to take all of their losing bets to the Treasury, which will buy them at an above-market price- if it wasn't an above market price, the owners could just sell it on the market. Wall Street will keep its profitable investments, and unload its bad investments on the rest of us. This is going to be a massive dump of toxic trash to the taxpayers books.

I have been saying since the 2008 bailouts that this was going to be a situation where the connected dump all of their losing investments on the taxpayers while keeping the winnings for themselves. But even then, I never understood how to get the last piece in place- those purchases from the 09 bailouts were not on the books of the U.S. Government, but the consortium of private banks managing our currency- the Federal Reserve System. I had wondered exactly how they were going to get their losing bets transferred to the taxpayers books. This is how. This is the conduit for the largest bank robbery in world history- but its the banks and hedge funds that are robbing the rest of us.

What I said at first, about the Federal Reserve not "charging interest off of money we create from thin air" directly from taxpayers won't apply anymore. The Federal Reserve will charge taxpayers interest for money they create out of thin air. If they remit that money back to the Treasury, it will only be so that Treasury can buy the losing assets of Federal Reserve Member banks at above-market prices. They have a system in place where they absolutely cannot lose money no matter what they do- but it is built on the backs of the honest labor of the rest of us. This plan is not some kind of godsend for the heartland, it is betrayal. Woodrow Wilson is supposed to have said on leaving office that he had "unwittingly betrayed his country". On his watch the Federal Reserve was created. Now, if he goes through with this, Donald Trump will also betray his country. We should pray that he doesn't follow through.

Get the books